maine excise tax exemption

An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles regardless of the number of transfers that may be required of the owner or lessee in that registration year. This exemption may also be granted to a veterans widower parent or child.

Negative List Of Itc Under Gst Itc Claimed Details On Motor Vehicles Food Beverages Catering Cabs Insurance Fi Outdoor Catering List Health Services

Where do I pay the Excise Tax.

. Adult Use Marijuana Licensing Ordinance. Excise tax imposed pursuant to 36 MRSA. Excise tax is paid at the local town office where the owner of the vehicle resides.

Excise tax on low-alcohol spirits products and fortified wines. Pay property taxes online. 36 MRSA 1483 sub-12 as amended by PL 2009 c.

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. The vehicle must have disabled veteran plates. City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently stationed at a military or naval post station or base outside of the State of Maine or who are deployed for military service for more than 180 days.

2021 Commitment by name. 2021 Tax commitment information. City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently stationed at a military or naval post station or base outside of the State of Maine or who are deployed for military service for more than 180 days.

Contact 207283-3303 with any questions regarding the excise tax calculator. Parapalegic veterans may be eligible for additional exemptions. Veterans Excise Tax Exemption.

Board of Appeals Ordinance. 434 20 is further amended to read. The amount of this exemption is currently 6000.

A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. 692021 - PASSED TO BE ENACTED. 1483A which expressly - authorizes such ordinances.

The purpose of this ordinance is to grant an excise tax exemption for residents of the Town of Gray. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper. Vehicles traveling in the State only in interstate commerce that are owned in a state where an excise or property tax has been paid on the vehicle and that grants to Maine-owned vehicles the exemption provided in this subsection.

Sponsored by Representative Heidi Brooks. This ordinance is enacted pursuant to 36 MRS. This state program allows owners who are enrolled in the homestead exemption are at least 65 or unable to work due to disability have income of less than 40000 and liquid assets of less than 50000 or 75000 if filing jointly to defer postpone payment of property taxes until they pass away move or sell their property at which time the deferred tax plus interest must.

This Ordinance shall be known and may be cited as the Active Duty Military Excise Tax Exemption Ordinance of the Town of Gray Maine. March 9 2022 News. Below you will find the Town of Eliot Boat Excise Tax Payment Form for downloadcompletion along with the Maine Watercraft Excise Tax Table for computing the boat excise tax due.

Property Tax Maps and Information. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle boat or camper trailer. Blind exemption - this exemption is granted to an individual who is legally blind.

Be it enacted by the People of the State of Maine as follows. 2021 Commitment by maplot. In Maine certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Automobiles owned by veterans who are granted free registration of those vehicles by the. The Maine Legislature passed a bill that gives 100-disabled veterans exemption from excise tax on one registered vehicle. Excise Tax is an annual tax that must be paid prior to registering your vehicle.

The excise tax due will be 61080. Please contact our office 207-439-1817 with any questions or for assistance with the calculation of. LD 1193 HP 871 An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax.

The amount of the exemption is currently 4000. What is Excise Tax. To qualify for this exemption the resident must present to the municipal excise tax collector certification from the commander of the residents post station or base or from the commanders designated agent that the resident is permanently stationed at that post station or base or is.

By Maine Heritage Policy Center. SECTION 3042 AUTHORITY. Publications and Exemption Applications.

Comprehensive Plan Revised 2005. An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. Board of Assessment Review Ordinance.

Active Duty Stationed In Maine Excise Tax Exemption MV-7 Antique Auto Antique Motorcycle Horseless Carriage Custom Vehicle and Street Rod Affidavit MV-65 Authorization for Registration MV-39 Disability PlatesPlacard Application PS-18 Duplicate Registration MV-11 Emergency Medical Services Plate Application MVR-17. Several examples of exemptions to the sales tax are most grocery products certain types of prescription medication some medical equipment and certain items which are associated with commerce. They are also exempt from one title fee.

Shoreland Zoning supplemental application. Except for a few statutory exemptions all vehicles including boats registered in the State of Maine are subject to the Excise Tax. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

Military Exemption From Vehicle Excise Tax. MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION AFFIDAVIT OF EXEMPTION For purchases of electricity fuel or depreciable machinery or equipment for use in commercial agricultural production commercial fishing commercial aquacultural production or commercial wood harvesting pursuant to Section 2013 of the Maine Sales and Use Tax Law. This information is courtesy of Larry Grant City of Brewer Maine The same method will be used to calculate the fees to re-register the same vehicle.

Catalogs 44 Spiegel Fall Winter 1961 Part 1 1960s Fashion Vintage Outfits Fashion

Pennsylvania Base And Elevation Maps Pennsylvania Carbondale Erie Pennsylvania

Payroll Services Its Features Income Tax Income Tax Return Income Tax Preparation

Adobe Reader 9 Software Free Download For Windows 7 Freeware Federal Agencies Software Apps

Download Gst Tran 2 Return Excel Template Exceldatapro Excel Templates Excel Templates

All About Gst Composition Scheme 3 3 Turnover Limit Input Credit Returns Faq Composition State Tax Schemes

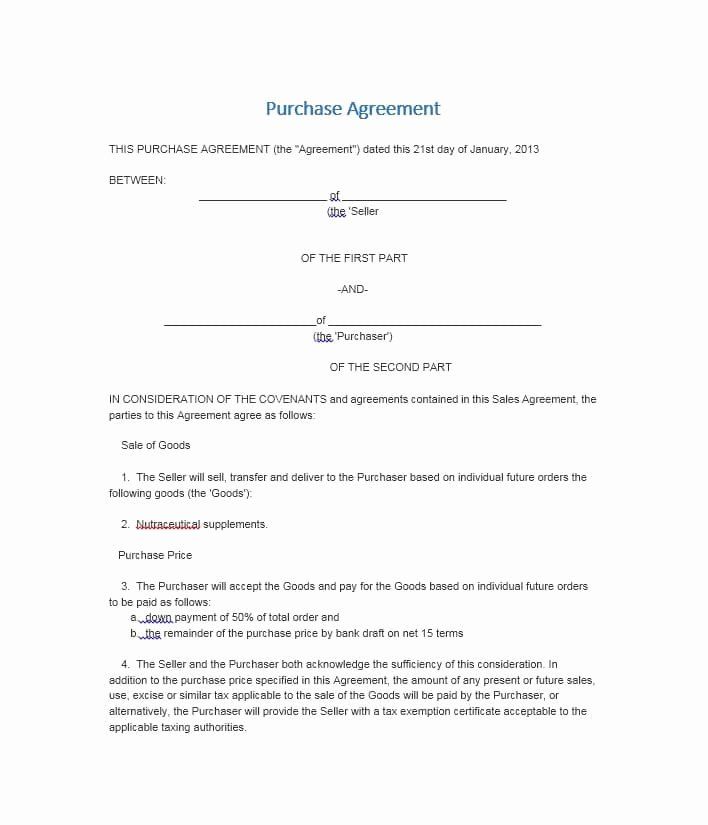

Business Sale Contract Template Luxury 37 Simple Purchase Agreement Templates Real Estate Business Contract Template Purchase Agreement Purchase Contract

All About Gst Composition Scheme 3 3 Turnover Limit Input Credit Returns Faq Composition State Tax Schemes

Maulana Abul Kalam Azad Early Life Education Freedom Struggle Education In India Indian Institute Of Science Education

Buy Amul India Twilight Tryst Single Origin Dark Chocolate 125g Online In Bangladesh From Cellsii Com Tease And Indulge Your S Amul Dark Chocolate Chocolate

Benefits Of Gst Tax Advocate India Prevention Advocate Benefit

New House Argentina Viviendas Industrializadas Casas Industrializadas Casas Premoldeadas Casas Rusticas De Ladrillo

Arkansas Sales Tax Exemption Form Form Tax Arkansas

Puerto Rico Maps Puerto Rico Map Puerto Rico Puerto Rico History

Puerto Rico Maps Puerto Rico Map Puerto Rico Bioluminescent Bay Puerto Rico